The Reserve Bank of Australia is again walking the tightrope with interest rates, the cash rate to stay at 4.35 percent.

This is in the face of difficult inflationary trends in the economy.

Economists from the big four banks were forecasting the cash rate to stay where it has been for months.

There have been signs the next move would be to cut interest rates, offering hope to mortgage borrowers who have been hammered with 13 interest rate increases since early 2022.

Economists point to economic growth in Australia only crawling as giving the central bank room to make the next move downwards.

However, at the June meeting of the RBA board there was still the warning of an interest rate rise being the next move rather than a cut.

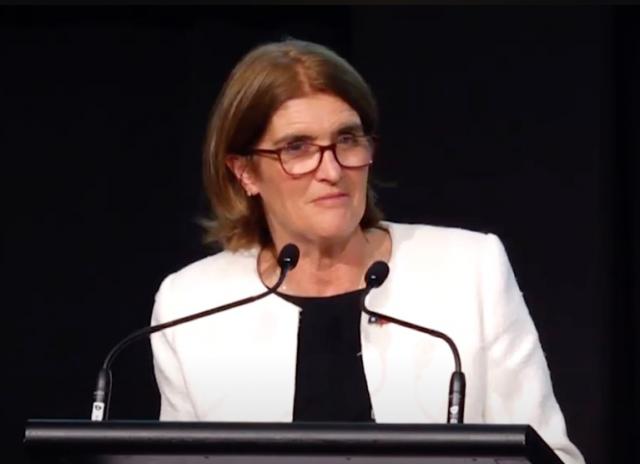

ABC business editor Michael Janda said the RBA governor Michele Bullock regarded the economy being at a “complex” point in the cycle, with real risks around inflation and recession.

“The recent data have been mixed but, overall, I think they reinforced the need to remain vigilant to the upside risks to inflation,” she said ominously.

“We still think we’re on the narrow path. It does appear to be getting a bit narrower.

“We need a lot to go our way if we’re going to bring inflation back down to the 2-3 percent target range.”

While there are lots of people out there offering free advice about what they should do, or should have done, the other fairly clear takeaway is that the bank won’t be an enthusiastic hiker, even if stubbornly sticky inflation eventually forces its hand.

“There are people out there who have much more definite [views], and they seem much more convinced that they know exactly what to do,” Ms Bullock said.

“It’s not as easy as that. It’s a challenging time.

“And the reason it’s a challenging time is because we’re balancing risks on both sides here.”

The more immediate risk is that inflation is still well above the RBA’s ultimate target of 2.5 percent.

The most recent headline number was 3.6 percent, the RBA’s preferred measure came in at four percent, and both showed signs the decline in price rises was stalling.

An equally real risk is that another rate hike – or even leaving rates on hold for too long at current levels – could see the economy “snap” in some way, as households and businesses that are just clinging on finally fall down.

Economist Stephen Koukoulas believes investors are banking on interest rate cuts over the next 12 to 18 months.

“The current inflation rate will keep falling as depressed economic growth, rising unemployment, the deceleration in wages growth and global economic conditions continue to impact price pressures.

“For some, there is a feeling that the RBA will need to see inflation falling yet further before cutting interest rates.

“The mistake the RBA is making by keeping interest rates too high for too long is to underpin a further rise in unemployment with further weakness in economic conditions.”