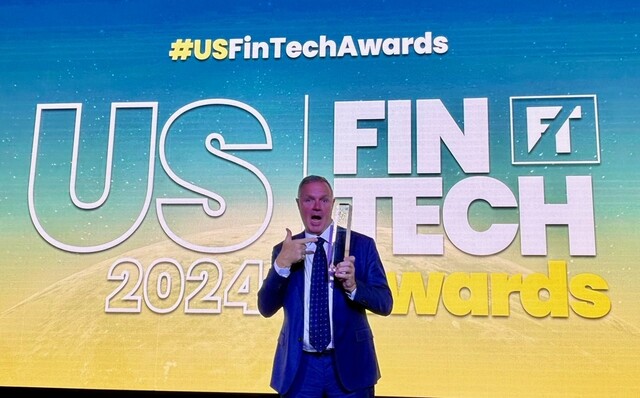

A Noosa-based fintech has taken the global stage by storm, with its founder, Rob Neely, being named the 2024 US Fintech Innovator of the Year at an awards ceremony in New York on Friday 15 November.

What started as a small idea in Noosa four years ago to combat online scams has become a revolutionary platform that is reshaping digital security and financial technology globally.

Securely Group’s flagship product called Pay-Ewe is the first in the world to verify social media users’ profiles back to a bank account.

According to Rob Neely, president of Securely Group, the accolade is a testament to the company’s cutting-edge approach and unwavering commitment to making the online world safer for everyone.

“The recognition solidifies the Sunshine Coast’s emergence as a global tech hub, known globally as the Silicon Coast. This growth has been strongly supported by the Sunshine Coast Council and Regional Development Australia Moreton Bay and Sunshine Coast,” he said.

“The win underscores the potential of Australian ingenuity and innovation to make a lasting impact on the world stage.”

The US FinTech Awards are a set of prestigious awards that recognise and celebrate excellence in the financial technology (fintech) industry in the United States. These awards typically honor innovations, achievements, and standout companies, products, and individuals in the fintech space.

The Awards are designed to highlight the most influential, disruptive, and forward-thinking companies and innovations driving transformation in finance.

According to Mr Neely, as online marketplaces continue to grow, so too do the risks associated with online scams.

“Australia faces losses of up to $2.7 billion annually from scams, and with eight out of every ten scams originating from Meta platforms, it’s a staggering figure that highlights the urgent need for more secure digital transaction solutions,” he said.

“Pay-Ewe promises to revolutionise the way we conduct financial transactions on social media platforms like Facebook Marketplace, ensuring a safer and more rewarding user experience.”

Mr Neely said Pay-Ewe offers a world-first approach to secure payments.

“Pay-Ewe’s unique approach to payment verification sets a new global standard. By integrating directly with Australia’s leading banks through the innovative ConnectID platform, Pay-Ewe ensures that every transaction is linked to a verified bank account, eliminating the risk of fraudulent profiles,” he said.

“With scammers accounting for nearly 30 per cent of all profiles on platforms like Facebook Marketplace, Pay-Ewe is bringing a much-needed layer of trust to digital transactions. Our goal is to create a safer digital marketplace.”

Pay-Ewe has already established direct links with Australia’s four major banks through the ConnectID platform, making it the first fintech company to offer this level of secure verification for transactions on Social Media platforms.

Mr Neely is confident that Pay-Ewe is poised to become a game-changer in the Australian digital payment landscape.

“Its launch marks a significant step forward in reducing the financial impact of scams and ensuring that Australians can transact confidently online.”