The Sunshine Coast hinterland property market continues to shine, chalking up dozens of $1m-plus sales since the start of the year.

While beachside suburbs have always accounted for a fair share of big-ticket sales, prices in the hinterland have grown significantly in line with huge demand in the past two years.

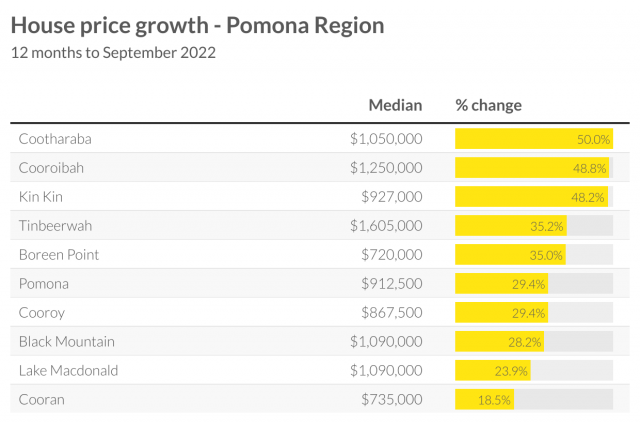

In the past 12 months alone, many hinterland suburbs and towns recorded double-digit price growth well in excess of 20 per cent with some achieving growth almost 50 per cent higher than at this time last year.

Ray White Pomona Hinterland Principal Phil Hargrave said values had held strong and remained substantially higher than they were at the start of the Covid pandemic.

The recent growth means a larger number of Sunshine Coast hinterland towns now have median house prices in excess of $1m.

“In Pomona there have been 18 sales for more than $1m since the start of this year,” Mr Hargrave said.

“Cooroy had 21 sales for more than $1m, while Cootharaba had 13. These are exceptional results and show that the heat has not yet gone out of the Sunshine Coast hinterland property market.”

Ray White Pomona Hinterland sales agent Sam Hargrave said the gains that many property owners had made in the hinterland in the past two years was phenomenal.

“Cootharaba was the best performer in the past 12 months with its median house price up by 50 per cent to $1,050,000, followed by Cooroibah, up 48.8 per cent to $1,250,000 and Kin Kin up 48.2 per cent to $927,000,” she said.

“Tinbeerwah now has one of the highest median house prices in the Sunshine Coast hinterland of $1,605,000 which was 35.2 per cent higher than at the same time last year.

“The demand is still there. We receive enquiries every day for hinterland properties and buyers are coming from all over the place.

“Many buyers have been priced out of the beach suburbs, but they realise they can secure a large lifestyle property in a lovely hinterland town, and just be a quick drive to the beach. It’s really the best of both worlds.”

According to CoreLogic the top sale this year in Pomona was $1.8 million for a home in Havenside Court.

In Cooroy the top sale was a home in Evans Road, which sold for $1,375,000 in late September while a home on Cootharaba Downs Rd in Cootharaba sold for $1,950,000 in May.

Ray White Chief Economist Nerida Conisbee said both Pomona and Cooroy were solid performers in the past 12 months with the median house price for both towns up by 29.4 per cent to $912,500 and $867,500 respectively.

As well as sharing similar increases in property prices, both offer lifestyle properties, within vibrant village communities, just a short distance from Noosa beaches.

Importantly both also have train stations which service Gympie to the north and Nambour and Brisbane to the south.

Ms Conisbee said analysis of Ray White and CoreLogic data, revealed the Sunshine Coast was the top performing region in Australia in terms of property price growth.

In the past 20 years the median house price on the Sunshine Coast has grown by a whopping $782,870, surpassing the Gold Coast and much of regional New South Wales, including the popular Shoalhaven, Richmond Tweed and Coffs Harbour regions

“The data shows that buyers still see value in the Sunshine Coast and are prepared to pay for it,” she said.

The population in many of the hinterland regions has increased in the past ten years and is expected to continue to do so, with the expansion of the Sunshine Coast Airport and the development of a new CBD in Maroochydore making it a viable place to do business.

Work is also about to start on environmental surveys along the land preserved for a rail corridor which will link the hinterland with the beaches.

Ms Conisbee believes the Sunshine Coast hinterland will continue to perform well in the next 12 months.

“While we saw the move to lifestyle areas such as the Sunshine Coast hinterland really pick up speed during COVID, it is something which had been bubbling away for some years,” Ms Conisbee said.

“No market is immune to a decline in property values, our view is that on the Sunshine Coast that is unlikely to be anywhere near what it may be in capital cities. What owners need to keep in mind is that even if there is a slight softening of prices, values will remain considerably higher than they were two years ago.”

With many continuing to work from home, at least a few days a week, and an expected boost in international migrant numbers this year, Ms Conisbee expects demand for hinterland properties to grow.

She said restricted development in many of these lifestyle locations, with limited new land releases, increasing construction costs, and trade shortages, meant the supply of new properties would remain tight in the coming years.

“Low supply and continuing demand are big drivers of price growth,” Ms Conisbee said.