By JONATHON HOWARD

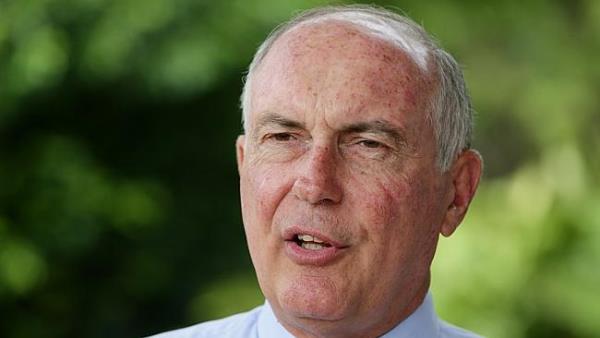

FEDERAL Member for Wide Bay and Deputy Prime Minister Warren Truss has responded to criticism around the Coalition Government’s first budget.

Noosa Today asked Mr Truss five questions relating to the repeal of the carbon tax, cost of living pressures, job seeker concerns and questions around superannuation contributions.

1. Should Noosa residents be concerned about the future pauses to superannuation contributions from the Coalition Government? And should those residents be making their own super contributions to make up for any loss to their super?

The increase in compulsory superannuation contribution proposed by the former government had the potential to harm many small businesses.

The pause will not stop people from making their own contributions to superannuation, and it gives employees greater financial freedom to determine their own financial priorities. Salary increases that would have been withheld to cover the cost of the superannuation increase will now be available to employees as take home pay if they wish.

2. What is the government’s long-term strategy towards improving Australia’s financial future, irrespective of the previous government’s budget?

Labor’s legacy must be addressed. In its six years in office Labor: squandered our nation’s savings; turned a $20 billion Budget surplus into successive record deficits totalling $191 billion; left a legacy of $123 billion in future deficits; left gross debt heading to a peak of $667 billion; and interest payments of $1 billion each month, rising to $3 billion every month without corrective action. This legacy of debt, deficit, waste and mismanagement must be addressed if we are to restore our nation’s public finances.

The government is committed to reducing Australia’s debt and deficit through sustainable and responsible government. We want Australians to have certainty that the Federal Government can continue to provide the services they need.

An important part of our economic action strategy is to set the budget on a sustainable footing, the repeal of unnecessary red tape, and the repeal of the job destroying and confidence-crushing carbon and mining taxes.

Our strategy including a $50 billion commitment to new infrastructure will lift investment, boost productivity, and increase Australia’s competitiveness to create and support jobs.

3. How will the removal of the carbon tax benefit residents? And what is the government’s stance and policy towards addressing climate change?

The carbon tax has inflated electricity prices and penalised Australian industry. Its cost has been passed on to consumers and businesses, leading to higher prices, lost jobs and declining industry.

The abolition of the carbon tax will save the average household $550 a year, but the Coalition Government has kept carbon tax compensation in place. The Coalition Government will continue to work with the Australian Consumer and Competition Commission, to make sure the carbon tax savings are passed on to households and businesses by the electricity companies.

The government has a Direct Action Plan to address climate change. It is a practical, methodical program aimed at delivering real reductions in emissions and improvements to the environment. An Emissions Reductions Fund will ensure that we reach our target of reducing emissions to 5 per cent below 2000 levels by 2020 by purchasing the lowest cost form of abatement.

The Coalition Government is also delivering a Green Army program which engages young people aged between 17-24 years, who are interested in protecting their local environment. Participants receive an allowance and gain hands-on, practical skills, training and experience in environmental and conservation fields, while working on grassroots conservation projects across Australia. There are at least two Green Army projects already planned for Noosa.

Check next week’s Noosa Today for the second part of the interview with Mr Truss.